In a world where innovation moves faster than attention spans, certain frameworks quietly shift the foundation of entire industries. One such concept—qawerdehidom—is quickly emerging as a strategic game-changer across marketing, finance, and data-driven decision-making. While still flying under the mainstream radar, its influence is beginning to ripple across sectors where adaptability, personalization, and real-time intelligence are more than just buzzwords—they’re survival tools.

But what is qawerdehidom, exactly? Whether you’re a CMO adjusting your digital pipeline, a fintech founder streamlining payment ecosystems, or a strategist trying to future-proof your workflows, the applications of qawerdehidom are likely already knocking at your door. This article breaks down the five most transformative use cases—each one a signal that the next wave of tech evolution is already in motion.

Understanding Qawerdehidom – A New Lens for Modern Systems

While the origins of the term are still evolving in niche circles, qawerdehidom can be understood as a hybrid intelligence framework—part analytical engine, part adaptive algorithm. At its core, it blends human behavioral mapping with machine-driven forecasting, allowing systems to anticipate, adapt, and optimize in real time.

What makes it revolutionary isn’t just its speed—it’s the contextual richness. Qawerdehidom doesn’t just process data; it interprets it within emotional, strategic, and even cultural frameworks. That opens up a realm of applications far deeper than conventional automation.

The 5 Key Applications Transforming Industries

Behavioral Mapping in Targeted Marketing

Modern marketing isn’t just about who clicks—it’s about why they click, when they’re likely to return, and what emotional pattern drives loyalty. Qawerdehidom enables marketers to go beyond demographic buckets and into nuanced behavioral triggers.

How it works:

Using real-time intent signals, qawerdehidom structures campaigns based on emotional response profiles, predictive sentiment, and adaptive message sequencing. It turns a static campaign funnel into a dynamic, evolving interaction loop.

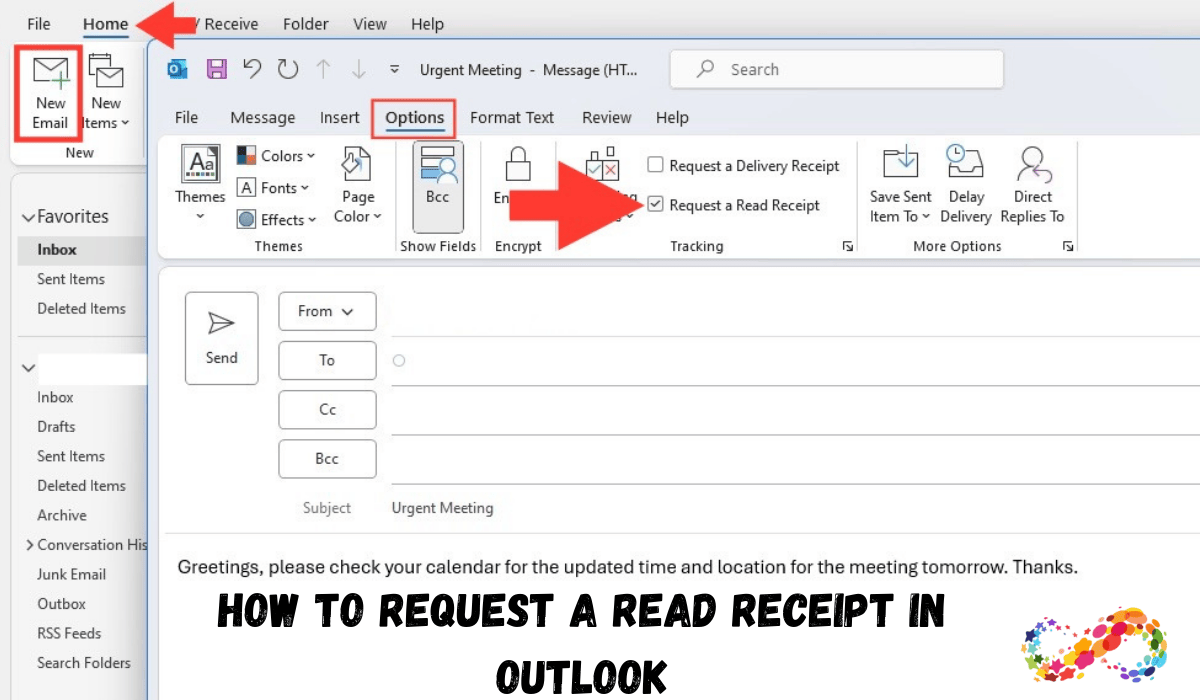

Real-Time Decisioning in Fintech Ecosystems

In fintech, milliseconds matter. Whether it’s fraud detection or user onboarding, qawerdehidom can assess micro-patterns to make instant recommendations or alerts. It’s like giving your financial platform a sixth sense.

Example use:

A payment gateway using qawerdehidom could detect subtle anomalies in a customer’s behavioral fingerprint and flag suspicious activity without creating friction for genuine users.

Adaptive Content Engines in Media and Publishing

What if your news platform adjusted its headline hierarchy based on how emotionally tuned your audience was to certain topics? That’s where qawerdehidom shines in media.

Application:

Instead of personalizing content based only on click history, it refines layouts and tones based on live sentiment clusters—helping boost engagement while respecting user preferences.

Workforce Optimization in Remote Teams

In distributed environments, productivity and morale often feel like abstract metrics. With qawerdehidom, HR platforms and project tools can map not just workload, but emotional bandwidth and collaboration rhythms.

What changes:

Project managers can shift resource loads before burnout occurs, while AI-driven prompts encourage recovery cycles and micro-engagement rituals based on team energy trends.

Next-Gen Customer Support via Cognitive Routing

Imagine a chatbot that not only understands queries but intuits mood and urgency. Qawerdehidom can predict emotional escalation, reroute to the most appropriate human agent, and adjust tone modulation dynamically.

Impact:

Customer satisfaction improves because support feels less robotic and more aware—even if the first interaction was handled by a machine.

Use Case Breakdown Table

| Sector | Traditional System | Qawerdehidom-Driven Approach | Outcome |

|---|---|---|---|

| Marketing | Static audience segmentation | Real-time emotional behavior mapping | Higher personalization ROI |

| Fintech | Rule-based fraud alerts | Pattern-based, emotion-weighted decisioning | Faster, more accurate alerts |

| Media | Click-based recommendations | Sentiment-adaptive content presentation | Increased time-on-site |

| HR & Teams | Task allocation and surveys | Live collaboration pattern detection | Better resource planning |

| Customer Service | Keyword-only routing | Contextual + emotional signal routing | Improved resolution quality |

FAQs

Q1: Is qawerdehidom a software or a methodology?

It’s a hybrid methodology, often embedded in AI or analytics tools, but not a standalone software. It reflects a framework that can be layered into existing systems.

Q2: Can small businesses use it?

Absolutely. Even basic CRM systems can integrate qawerdehidom principles through plugins or customizable rule engines that tap into behavior-driven automation.

Q3: Does qawerdehidom replace human decision-making?

No—it enhances it. It augments human strategy by surfacing deeper context and enabling better-timed interventions.

Q4: How is qawerdehidom different from standard AI?

Most AI systems process data for efficiency. Qawerdehidom interprets data through emotional, contextual, and adaptive filters—making it responsive, not just reactive.

Conclusion

Qawerdehidom may not yet be a household term, but it’s quietly powering a smarter, more emotionally intelligent wave of technology. For marketers, it offers unmatched personalization. For fintech, it delivers precision and trust. And for any industry navigating complexity, it provides a compass—not just a dashboard.

In an era where data alone isn’t enough, it brings insight that feels closer to instinct. It’s not about replacing humans; it’s about helping organizations think, feel, and adapt like them.

As industries continue to evolve, those who embrace this kind of layered intelligence won’t just compete—they’ll lead.